| The Shameless Antagonist’s Modest Tax Proposal:

There isn’t anything wrong with hating taxes. I hate taxes; especially since I consider much of the money I contribute to be misspent. Government spending doesn’t reflect my beliefs and values, and it pains me to think I’m implicitly supporting a bloated military budget and tobacco subsidies, among other things. Fortunately, I live in a democracy, and ultimately, I have a say in expenditures to the degree I participate in the political process (this is a point too often lost on anti-government types)…As much as I hate paying taxes, I hate whiners that aren’t paying their fair share even more. The Shameless Antagonist’s Proposal: Free Tommy Chong and the stoners and imprison the tax cheats. In the spring, the main pastime of the wealthy seems to be finding a way to dodge taxes…They bleat and bluster, “I'm tired of hearing that the rich get all the tax breaks”, as they contact their offshore banks in the Bahamas. How often have you heard your wealthy Republican friends bitch and moan about oppressive taxes? You know you’re talking to a member of Rush Limbaugh’s conservative Borg collective when you hear the following quote, which appears on Limbaugh’s website… “According to the Internal Revenue Service's 2000 data for individual income tax returns, the top 50 percent of wage earners pay 96.09 percent of the total federal income taxes paid. The top 5 percent pay 56.47 percent of all income taxes; top 10 percent pay 67.33 percent; top 25 percent pay 84.01 percent of all income taxes.” I’m perfectly willing to cut Rush some slack and give him the benefit of the doubt--after all, he was probably high as a kite when it first appeared on his site, and his drug-addled brain could be a reasonable excuse for impaired cognitive abilities. As for his followers, though, I would ask that the woefully oppressed wealthy elite consider the following factors before hoisting high the banners of class warfare. I: The median income for the top 1% of all wage earners is $1, 082,000 while the median income in the United States is $42,000. Has the average wealthy taxpayer contributed 20 times as much to society as the average person? Was that cool million generated in a vacuum, or did the state and the people of the state foster the conditions that made success possible? The person making $42,000 is in the 25% tax bracket, while the person making $2,000,000 is in the 35% bracket. My argument is that having 20 times the wealth of the average person more than compensates for an additional 10% paid in taxes…Are the wealthy paying more than their fair share? Do the wealthy drive on publicly-maintained roads? Were their employees trained in public schools? Is the meat they eat certified by a federal agency? Are they protected by the (primarily lower tax bracket) armed forces? How many Rockefellers, Carnegies, Bushes, Kennedys, and Lays are combat veterans? II: What percentage of individual filers, do you suppose, are semi-retired elderly citizens, teenage coffeshop workers, or college students? My guess is that there are millions of Americans making less than a few grand a year, many of whom are the relatives of wealthy conservatives. Don’t you suppose they were counted in these statistics? Wouldn’t that skew the statistics in their favor, despite the fact that some of these individuals could be counted as dependents on tax forms? III: As many have noted, this statistic (quoted by Limbaugh et. alia), doesn’t take into account state, local, and payroll taxes. State and local taxes, in many places, are regressive rather than progressive, and due to the Republican philosophy of devolution of power to state and local authorities, states and municipal taxes are skyrocketing and local social services are being cut at the same time. IV. It takes money to make money; if I have 5,000 to invest in a CD, who will get a better rate of interest…me or the wealthy gentleman seeking to invest 100,000? Admit it. There is no level playing field. Until poor kids are able to choose their parents In Utero, Conservative complaints about tax fairness will remain a pathetic farce… The Shameless Antagonist says…Only if one concludes that all Americans pay too much in taxes can one argue that the wealthy pay too much in taxes…We could get by paying less in taxes, conceivably, if the I.R.S. cracked down on tax cheats. For the better part of a decade, Ginrich, Lott, and others have laboured to make the I.R.S. a toothless tiger...My suggestion to the Democrats is to make this an integral part of their platform in November. The Republican legislature has worked in the shadows to limit the enforcement abilities of the I.R.S., but let’s see them argue publicly against punishing tax cheats! |

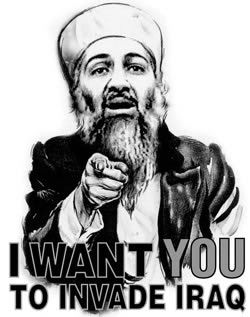

Read How Bush Helped Osama Recruit Here

Lies That Led To War: Read The WMD B.S. Here

Under Construction

construction

construction ...

text

text

Photo...

News And Commentary

- Media Matters for America

- Cursor

- The Guardian

- Goderich Signal Star

- The Strib

- The Toronto Star

- The Poutine Diaries

- 917 Press

- Manufactured Environments

- Journal of Genki

- Rick and Heather

- Jason Coleman

- Paperback Writers

- andtheansweris

Noteworthy & Quoteworthy:

Previous Posts

- Remember When... Meet the Press Sunday, September...

- Join the Shameless Antagonist's Presidential Praye...

- Have A Wonderful Thanksgiving, Everyone! The Sh...

- Brain Teaser of the Week: The Shameless Antagonist...

- The Mother of All Compassionate Conservatives Her...

- Welcome to the Jobless Recovery... The news today...

- Remember When... "VICE PRES. CHENEY: Well, I don...

- THE SHAMELESS ANTAGONIST PRESENTS... POINT/COUNTE...

- Bring Back the Gray Panthers!... From the Gray Pa...

- They Used to Call Them War Profiteers... Pssst......

Comments on ""

post a comment